We've spent the past decade helping entrepreneurs to incorporate and set up their small businesses.

Over that time, we've identified 6 key questions that most business owners ask, or wish they had asked, prior to incorporating.

In this post we'll review those questions and provide some answers.

Taking a few minutes now to consider these issues could save you time, money, and stress down the road.

Should I incorporate my business?

Should I incorporate? is the first question you should ask before taking any steps to set up a business.

Depending upon the facts, incorporating your business could make a whole lot of sense, very little sense, or something in between.

Here are some of the things to consider when deciding whether you should incorporate a business:

- Whether you'll be in business alone or with others - Although there are many benefits to incorporating a business with one owner, it becomes even more important if there are multiple owners.

- The degree of risk associated with business operations - The riskier your business, the more important it will be to incorporate.

- Whether the business will have employees - If you have or plan to have employees, incorporation can provide significant protection for the business owners.

- The amount of income expected to be generated - The greater the value of the business (current or expected), the more important it will be to incorporate.

- Whether the business brand is important to protect - Incorporation can provide some protection for your business name. If name protection is important to your business, incorporating may be the right choice. Incorporation can also provide credibility for your business, making it appear like a larger organization.

- Whether you plan to sell or transfer the business in the future - Being incorporated provides more options when selling or transferring the business. In many cases, there can also be tax benefits to selling shares of a corporation (using the lifetime capital gains exemption), instead of selling the business assets.

- Whether you intend to raise money for your business - Operating a business through a corporation not only makes it easier to borrow money from certain lenders, it also allows you to sell shares to qualified investors.

When deciding if you should incorporate a business, it's important to consider both your current situation, as well as where you expect the business to be in 3-5 years from now.

Although you can incorporate a business at any time, it can be quite a hassle and expensive to transfer your business to a corporation after it's developed.

That's because you'll need to transfer all of the business assets (which could be taxable), open new bank and government accounts, and revise all existing contracts. You'll also need to start operating under a new legal name. All of this takes time and money that would be better spent trying to grow your business.

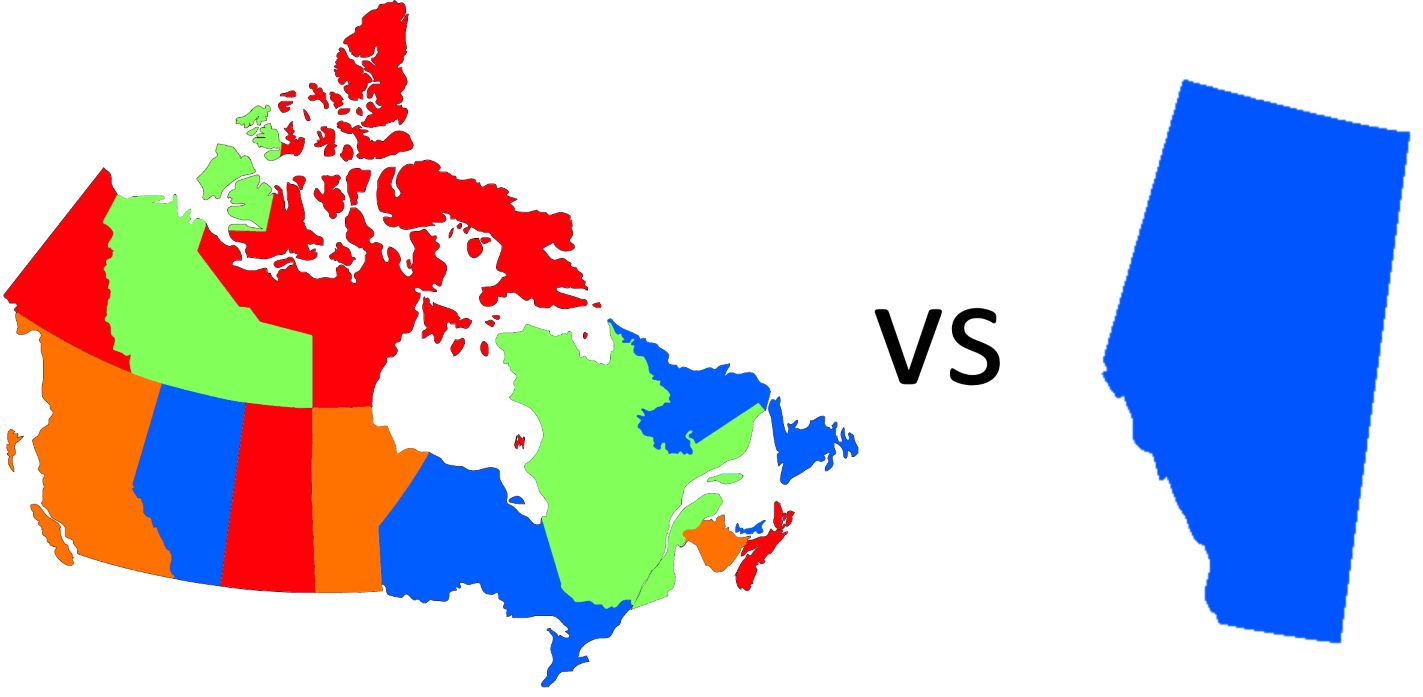

Should I register a federal or provincial corporation in Canada?

The first question you should ask after deciding to incorporate, is whether you need a federal or provincial corporation.

One of the most frequent mistakes we see being made by business owners that incorporate online is incorporating the wrong type of corporation for their circumstances.

Many first time business owners think that because they sell stuff online or carry on business in more than one Province, they need a federal corporation instead of a provincial one. In most cases that's not true.

Choosing to register a corporation federally instead of provincially is almost always more expensive overall and isn't necessary for most small businesses.

We've previously written about the differences between federal and provincial incorporation in Canada, so we won't go into too much additional detail here, however, the following are important facts to consider when deciding whether you should incorporate federally or provincially in Canada:

- Both federal and provincial corporations are required to register in each province in which they "carry on business". For federal corporations, this means that they must register federally as well as in at least one province (where the business is based). Provincial corporations will only require multiple registrations if they carry on business outside of the province in which they were incorporated.

- Because of the additional extra-provincial registration that is required for federal corporations, they are typically much more expensive to set up than provincial corporations. An extra-provincial registration in Alberta for example typically costs between $500-$1,000 including agent and government fees. This is in addition to the federal incorporation costs. The primary exception to this rule is Ontario, where extra-provincial registration of a federal corporation is both easy and inexpensive.

- Although incorporating federally gives you some extra name protection for your business, the protection is quite limited and is nowhere near the protection afforded by a registered trademark. If you're incorporating federally just for the added name protection, you should carefully consider whether registering provincially and applying for a trademark would make more sense.

Choosing to register a corporation federally instead of provincially is almost always more expensive overall and isn't necessary for most small businesses. Although there are a few situations where federal incorporation makes sense (such as for large businesses with an international presence) most business owners would be better off incorporating provincially and considering applying for a registered trademark for their business name.

If you have questions about whether you should incorporate a federal or provincial corporation, we recommend that you speak with a business lawyer. Getting it wrong can lead to significant expenses that could have been avoided.

Should I choose a named or a numbered corporation?

One of the benefits to operating a business through a corporation is the ability to name your legal entity. Usually, this means coming up with an attractive name that you hope will be memorable for your clients.

Although named corporations are the most common choice, it is also possible to incorporate something called a numbered corporation. This means that you do not choose a name for your corporation, but instead, use a name that is automatically generated for you.

Your corporate name would be made up of a unique and automatically generated number (you do not get to choose), followed by the name of the jurisdiction in which you registered and a legal element.

For example, 17654321 Alberta Ltd. is an example of a numbered corporation that would be registered in Alberta. 9876543 Canada Corporation is an example of a corporation that would be registered federally. The only part of a numbered company name that you get to choose is the legal element (Ltd., Inc., Corp.).

You can read more about legal elements of a corporate name here.

In our experience, numbered corporations are rarely used for businesses with ongoing business operations. This is because it's less attractive (and arguably less professional) for clients to deal with 33414556 Alberta Ltd. than it would be for them to deal with a company called Uberfresh Laundry Services Ltd.

The latter is much easier to brand and is more likely to be remembered.

In our view, it's almost always better to choose a named corporation.

The one time that numbered corporations are common, is when the business does not carry-on active operations, but instead acts as a holding corporation.

A holding corporation is a legal entity that does not carry-on active business operations, and therefore does not need to worry about their brand. In most cases they simply hold shares of another corporation (sometimes used for tax and asset protection purposes) or other assets.

In our view, it's almost always better to choose a named corporation, even if the corporation isn't being used for active operations. Here's why:

- It is very easy to mess up the name of a numbered corporation. For example, 1234567 Alberta Ltd. looks a lot like 1234657 Alberta Ltd. Serious legal issues can arise from using the incorrect corporate name;

- Although you can use a registered trade name to help with branding, (ie 1234567 Canada Inc. operating as Dave's Dry Cleaning) it usually doesn't look very appealing as you should still clearly list the corporate name in order to maintain limited liability protection;

- The added cost to incorporate using a named corporation is very reasonable and it is a one-time fee paid at the time of incorporation.

If you want more information about the difference between a named and a numbered corporation you can read this article. If you still have questions, we recommend that you book a legal consultation. You can have your questions answered by an experienced business lawyer prior to making important decisions.

Shares represent ownership of a business. Shares can be issued by the corporation, transferred by shareholders, and used as security for the owner's debts, among other things.

There are many different types of shares that can and should be issued in different circumstances. For example, there are voting and non-voting shares, equity and non-equity shares, shares that are entitled to dividends and those that are not, preferred shares that are entitled to priority if the corporation is wound up or dissolved, and shares that are used for specific tax purposes.

The number and type of shares that should be issued at the time of incorporation will depend upon your specific circumstances, however, a corporation can only issue shares that have been properly authorized. For Canadian corporations, this means that the shares to be issued must be authorized by the Corporation's Articles of Incorporation.

This is one of the areas where many do-it-yourself websites and registry offices make mistakes or fail to provide businesses with the flexibility they'll need in the future. They either limit the corporation to issuing 1-2 different classes of shares or leave it to you to come up with a description of authorized shares. Neither of these options is good if you value both business flexibility and legal compliance.

This often means that income splitting opportunities are not available and/or that the Articles of Incorporation need to be amended in near the future.

This is where many do-it-yourself websites and registry offices make mistakes or fail to provide businesses with the flexibility they'll need in the future.

When you incorporate with a law firm, your corporation will typically be set up with Articles of Incorporation that include a wide range of share classes.

Often there are 15-20 different classes of shares authorized at the time of incorporation. This is done to ensure that the business owners have flexibility to issue different classes of shares at the time of incorporation, which can be beneficial for tax purposes. It can also prevent the corporation from having to make expensive changes to the Articles if the business owners decided to issue additional shares in the future.

Once the correct share structure is set up in the Articles of Incorporation, a decision can be made as to which shares should be issued at the time of incorporation. If there is more than one shareholder, it may make sense to issue a different class of shares to each shareholder.

Depending upon the circumstances, this can allow for income splitting that would not be possible if the Articles of Incorporation are not set up correctly.

Who should I involve in my business?

One of the biggest decisions to make when setting up a new corporation is who should be involved. Making a mistake at this stage in the game can have serious consequences.

Unless you're going to be a one-person business and act as the CEO, marketing department and chief bottle washer, you'll need to decide who should fill the following roles:

Shareholders

These are the owners of the business. Where there is more than one owner, we recommend speaking with a lawyer prior to registration about how to structure ownership, and whether your business needs a Unanimous Shareholder Agreement. Learn more about shareholders.

Directors

Directors are the primary decisions makers of the corporation. They're typically the ones that sign off on important documents such as contracts and cheques. Directors can also be personally liable for certain acts or omissions of the corporation. Learn more about directors.

Officers

Officers typically include a President, Secretary and Treasurer, but can also include positions such as CEO, Vice President, etc. Like directors, officers can be liable for certain acts and omissions of the corporation. It's important that the right persons be appointed to fill the various roles. Learn more about officers.

In addition to determining who will fill the above roles, you'll also have to select various service providers for the corporation. The most common service providers are bankers, accountants, and lawyers, however, there can be many more (think marketing professionals, business coaches, etc.).

Choosing the right partners for your business can make the difference between success and failure.

If you don't already have someone you trust that provides these services, try calling around. Don't be afraid to compare prices and services from several different providers. Most importantly, try to find someone that understands your business, and that can act as trusted partner in your quest for business dominance.

Choosing the right partners for your business can make the difference between success and failure.

Do I need a Lawyer to Incorporate my Business?

If you've considered the questions in this post, looked at the alternatives to incorporating as well as the pros and cons and decided that incorporate is right for you, the next question to ask is should I incorporate with a lawyer, or try to do it on my own?

It's fair to ask whether it's necessary to hire a lawyer to incorporate. After all, a business owner can save a few bucks by registering their business with a do-it-yourself website online or using a local in-person registry office.

It's true that lawyers can be expensive and that you can register a business without one, however, it's important to compare the true cost of incorporating with or without a lawyer.

If you choose to incorporate your business without one, your corporation will be registered, however, you won't receive legal advice and there's a very good chance that important steps will be missed.

The problems created by trying to save a few dollars up front can be devastating for your business.

If you believe in your business, and you've decided that incorporation is right for you, you owe it to yourself to ensure that it's set up correctly. Starting a business is stressful, time consuming and expensive enough, the last thing you want is to deal with expensive problems that could have been avoided with proper advice from an experienced business lawyer.

Trust your business to a professional. Get the advice and protection you need, without the headaches and uncertainty.

If you're wondering whether incorporation is the right choice for your business, we recommend completing our incorporation quiz. It will give you important information to help you decide whether incorporation is a good fit for your business.

Click the "Get Help" button below to book a consultation with an Alberta business lawyer about setting up your business correctly. It takes less than a minute to book and it's free if you incorporate your business with us. You'll get peace of mind knowing that you're making an informed decision.

Share this Article